In an alarming worldwide trend, it is reported that there has been a significant increase in new cancer diagnoses among younger individuals. Instances of early onset cancers diagnosed in people under 50 has increased globally by a staggering 79%, with data showing the demographics of cancer patients are shifting from older individuals to middle aged individuals.

The cause for the rate of increase has been attributed to several factors such as poor diet, physical inactivity, smoking and alcohol as major risk factors.

It is always important for us to be aware of own family medical history and that our lifestyle choices may increase the chances of developing the dreaded C. For example, if you are at high risk for colorectal cancer, it is recommended to go for screening at a younger age (before 50) and at more frequent intervals.

To avoid any potential financial hardship coming from critical illness, it is important to settle your basic insurance coverage as early as possible. Medical insurance should be the bedrock of your insurance planning. With the right medical insurance in place, you do not have to worry about the financial burden of hefty medical bills on your family and ensures that you receive the necessary medical treatment to recover.

Critical illness insurance will provide the insured a lump sum of money in the event of critical illness diagnosis. The cash payout to the individual serves to replace any potential loss of income due to critical illness, with the discretion left to the individual to decide how to use the funds.

Examples of how the individual or their family might utilize the cash pay-out include making home improvements to enhance comfort and accessibility for the insured or hiring a caregiver to take care of the insured.

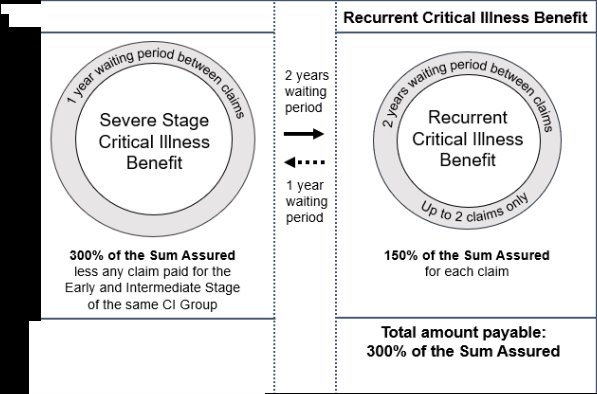

Singlife Mulitpay Critical illness is one of the most comprehensive critical illness plans in Singapore. It provides multiple claims on early, intermediate and late stage for 60 different critical illness as well as recurrent critical illness. Additionally, it also provides Intensive Care benefit, Benign and borderline malignant tumour benefit.

Scenario 1:

The insured is diagnosed with early Cancer and receives a lump sum pay-out of 100% of sum assured. Note: the policyholder will still have to continue paying for the policy premiums at this point.

6 months later, the early cancer progresses to severe stage Cancer. The insured will receive 200% of sum assured (300% of sum assured less any claim paid for the Early and Intermediate stage of the same CI group). As there is 300% of sum assured of critical illness benefit paid, the premium is waived and will continue to cover the insured under the policy ends.

Scenario 2:

The insured is diagnosed with early Cancer and receives a lump sum pay-out of 100% of sum assured. Note: the policyholder will still have to continue paying for the policy premiums at this point.

6 months later, the insured is diagnosed with Heart attack of Specified Severity and will receive 300% of sum assured. As there is 300% of sum assured of critical illness benefit paid, the premium is waived and will continue to cover the insured under the policy ends.

If this option is exercised, an additional 100% of the Sum Assured will be payable in one lump sum on top of the Severe Stage Critical Illness Benefit claim payable under the Critical Illness Benefit and the Recurrent Critical Illness Benefit shall cease.

List of eligible severe stage Critical illness for Advance Care option:

1. Major Cancer

2. Heart attack of Specified Severity

3. Stroke with permanent Neurological Deficit

4. Open chest heart valve surgery

5. Major Organ/ Bone marrow Transplantation

6. Coronary Artery Bypass surgery

Scenario 1:

The insured is diagnosed with Major Cancer and choose to receive 300% of sum assured pay-out, and maintain the recurrent critical illness benefit.

Scenario 2:

The insured is diagnosed with Major Cancer and choose to receive 400% of sum assured pay-out and forego the recurrent critical illness benefit.

List of eligible severe stage Critical illness for Recurrent critical illness benefit:

1. Major Cancer/ Re-diagnosed Major Cancer

2. Heart attack of Specified Severity/ Recurrent Heart attack of Specified Severity

3. Stroke with permanent Neurological Deficit/ Recurrent Stroke with permanent Neurological Deficit

4. Open chest heart valve surgery/ Repeated Open chest heart valve surgery

5. Major Organ/ Bone marrow Transplantation/ Repeated Major Organ/ Bone marrow Transplantation

6. Coronary Artery Bypass surgery/ Repeated Coronary Artery Bypass surgery

Scenario 1:

The insured is diagnosed with Major Cancer and choose to receive 300% of sum assured pay-out, and maintain the recurrent critical illness benefit.

2 years later, there is re-diagnosed major cancer and the insured receives 150% of sum assured.

Scenario 2:

The insured is diagnosed with Major Cancer and choose to receive 300% of sum assured pay-out, and maintain the recurrent critical illness benefit.

1 year later, there is re-diagnosed major cancer. However, as it does not satisfy the 2 years waiting period, the insured unfortunately will not receive the recurrent critical illness benefit pay-out.

Enquire with our partnered licensed financial advisors to compare and recommend the best critical illness insurance for you.

ertertyt ytr yty tryrtsy rt yrt ysrtysrt aer y