Since our review on Fundsmith Equity Fund, our readers have been wondering what other accredited investor fund they can invest as a tactical allocation to supplement Fundsmith Equity Fund? With that in mind, we shall take a look at Pictet Premium Brand Fund.

Managed by experienced investment managers Caroline Reyl and Laurent Belloni, Pictet Premium Brand fund boasts an impressive track record of performance. Pictet Premium Brand Fund provides investors with exposure on a worldwide level to a portfolio of premium brands, aiming to capitalize on the strong growth potential of companies associated with well-established and prestigious products and services such as LVMH, Hermes International, Ferrari.

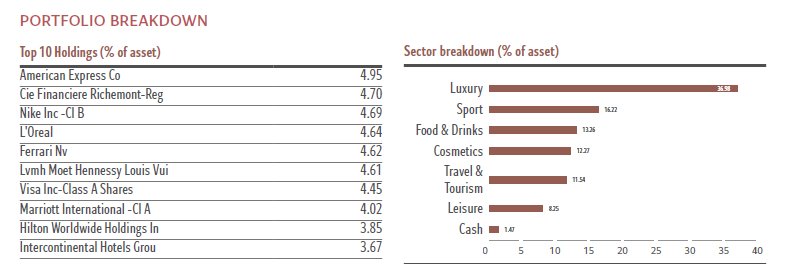

As the fund name suggest, the portfolio primarily focuses on companies associated with luxury goods, showcasing renowned names like Italian car manufacturer Ferrari, LVMH which is renowned for its coveted consumer brands such as Christian Dior, Louis Vuitton, Tiffany & Co, and Richemont (if you are unfamiliar with the name, Richemont encompasses some of the most prestigious names such as Cartier, Van Cleef, Vacheron Constantin).

While luxury is at the heart of the fund's investment philosophy, the fund also seek premium brands that possess pricing power and enjoy strong consumer loyalty. For instance, the fund holds positions in diverse sectors like the cosmetics giant L'Oreal, key financial brands such as Visa and American Express, and prominent hotel groups like Marriott International and Hilton Worldwide.

One interesting point to note of Pictet Premium Brand Fund is that although the portfolio predominantly composed of Western companies, the fund also strategically capitalizes on the economic growth in Asia, particularly in China. With increased purchasing power and a preference for premium Western products, the companies held in the Pictet Premium Brands Fund stand to benefit with the rise in the Asian economy.

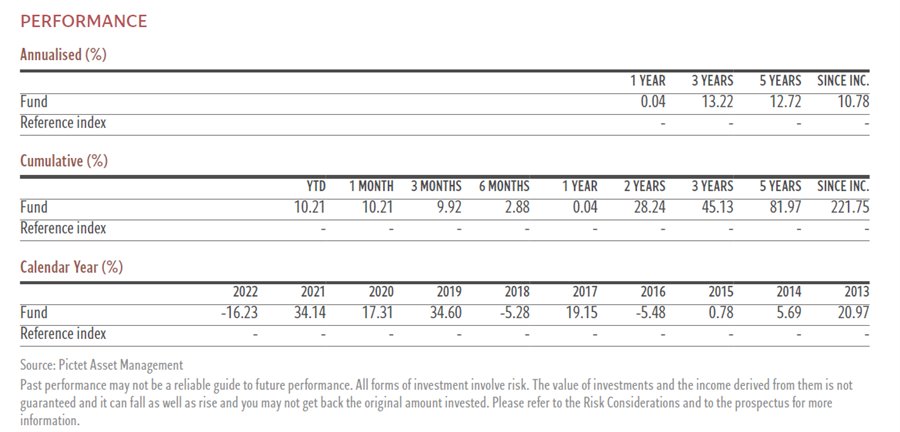

Disclaimer: It's important to note that past performance is not indicative of future results, and that investing always carries risks. It is essential for investors to thoroughly research and understand the risks associated with investing in any particular fund before making an investment decision.

Historically, the Pictet-Premium Brands Fund has delivered solid returns to investors, outperforming peer funds over the long term.

One key factor for Pictet Premium brands fund performance is that Premium brands generally exhibit long-term stability due to their lasting appeal and consumer stickiness to the premium brands. As a result, the fund's portfolio maintains a consistently steady and robust position.

If you are a retail investors looking to invest into Pictet-Premium Brands Fund, you can gain exposure to the fund via ILPs – Investment-Linked Portfolios. In Singapore, ILPs are regulated by the Monetary Authority of Singapore (MAS) and offered by various insurance companies.

Currently, only HSBC Life exclusively offers Pictet-Premium Brands Fund in their 101-ILP platform. To offset the fees and charges involved, HSBC Life offers attractive start up bonuses and loyalty bonuses.

Pictet-Premium Brands Fund is an attractive option for investors who believe in the growth potential of premium brands.

It is always recommended to consult with a qualified financial advisor before making any investment decisions. When considering any investment, it is important to evaluate several factors, including your investment goals, risk tolerance, and investment time horizon.

Speak to our licensed financial advisors to help you with your financial goals!

ertertyt ytr yty tryrtsy rt yrt ysrtysrt aer y