While the increasing interest rate in the market has hurt borrowers, it has also benefitted depositors with major banks in Singapore offering attractive fixed deposit rates of up to 3%p.a over 12 months or more. Safe instruments like fixed deposits have always been in demand (even back when rates were at a lower rate of 1%p.a) for the retail investors in Singapore as it allows them to sleep well at night knowing that their cash is secured.

However, this conservative approach of shying away from non-guaranteed financial instruments such as mutual funds or ETFs may hurt their overall assets in the long term too.

First off, let us explore what are the possible reasons people take flight from investing.

1. Lack of financial literacy

In a study done in 2020, only 1 in 5 feel knowledgeable about investing, and have misconceptions about when to start planning for their finances and retirement.

2. Misconceptions when it comes to investment

About 1 in 3 Singaporeans see investing as a form of gambling. Very often, their mindset to investment may have been influenced negatively by their peers or family members who have lost money in the stock market.

3. Lack of guidance

For those who attempted to invest on their own, they may have stopped investing due to the lack of advice/guidance during bear or down markets. As such, they may have acted irrationally, sold their assets and lost money during the down markets (Asian Financial crisis, United States housing bubble), and decided from then investing is not for them.

4. Influence, or lack thereof, from previous generations

Many Singaporeans may come from a generation where parents didn’t know a lot of investing. In fact, there are many instances where the only form of money management comes from savings accounts as low as 0.05%p.a, or even putting money into biscuit tin can. This habit could therefore be passed down to their children, without them knowing the world of investing.

In a survey commissioned by Moneysense in 2017, it is noted that 9 in 10 residents understood investment with higher return also comes with higher risk. There is no debating that there is risk involved when it comes to investing. However, we also have to ask ourselves if there is any risk in not investing too?

The wealthiest primarily generate their wealth via assets such as common stocks, property, commodities, and hold little or no cash. If you wish to start or restart your journey to investing, here are 3 quotes to keep in mind.

Peter Lynch, as a Mutual fund manager of the Magellan Fund at Fidelity Investments between 1977 and 1990, averaged an astounding 29.2% annual return during this 13 year tenure.

A simple google search of ‘what stock to buy now’’ will yield thousands of search results recommending the best stocks to own now. But the question is, is it really the best stocks to own if you do not understand the business?

‘’Know what you own and know why you own it’’ - Peter Lynch

In a lecture in 1994, he explained that he made 10 to 15 times his money owning in ‘Dunkin Donuts’ as he can understand the business behind the stock, and didn’t have to worry about what was happening to the business even during recessionary periods.

Fun Fact; interestingly enough, according to Fidelity investments, the average retail investor who bought into the Magellan fund have lost money during Lynch’s tenure there. This phenomenon was largely attributed to the behavioral challenges investors faced, when they bought when prices at a high and sold when price went down in a short period of time.

‘’The investor’s chief problem, even his worst enemy, is likely to be himself’’ – Benjamin Graham

Benjamin Graham, one of Warren Buffett’s professors, largely summarized the bane of investing boils down to behavior of the investor during market volatility. In his book, the intelligent investor, he describes the stock market as Mr. Market, an imaginary investor who is prone to erratic swings of pessimism and optimism.

Loss aversion, in behavioral finance, describes why investors experience twice as much pain in losing money, than the pleasure of gaining money. Simply put, it feels more emotionally damaging to lose $100, than emotionally uplifting to gain $100.

Such cognitive bias in investors may cause them to make irrational decisions to sell during a down market, when in reality, the valuations at a more attractive level. Of course, when the stock market is down, and with daily news outlet reporting fear, uncertainty and doubt, it is much easier said than done to keep a cool head.

‘’1. Buy good companies 2. Don’t over pay 3. Do nothing’’ – Terry Smith

Terry Smith, also widely known as the English Warren Buffet, advice to investors while simple is hugely underrated. Terry Smith is the founder and chief executive of Fundsmith.

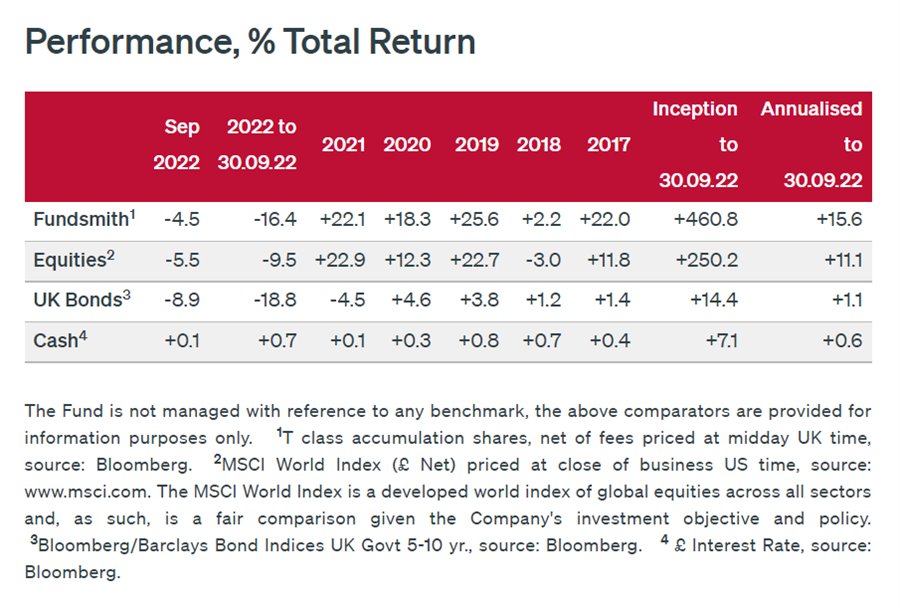

In their investor Owner’s manual, it states ‘’we aim to run the best fund ever. By best fund, we mean the one with the highest return over the long term, adjusted for risk’’. A bold statement indeed. Let us see the performance of Fundsmith Equity fund over the years.

Disclaimer: This is not an investment/financial advice and as always when it comes to any investments, past performance does not guarantee future returns.

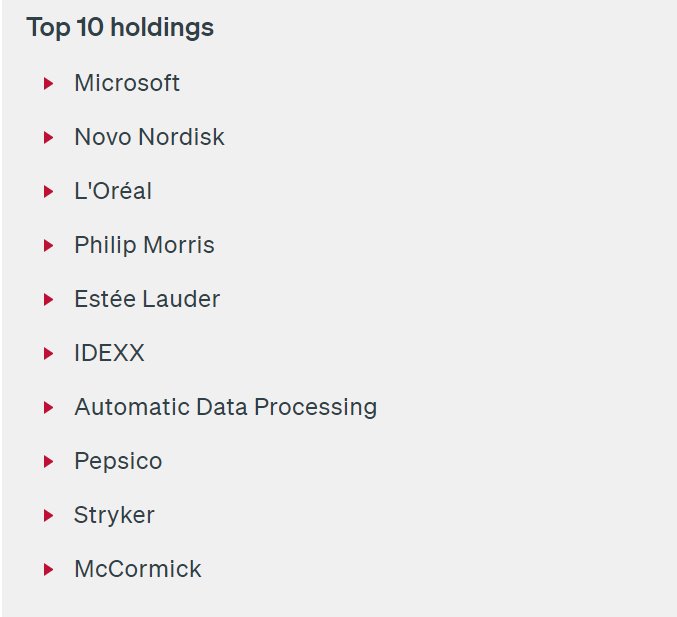

As we can see, the fund has outperformed most mutual funds, and even beating the MSCI world index since the fund inception. How did Fundsmith Equity Fund manage to achieve this goal?

1. We aim to buy and hold

2. We aim to invest in high quality business

3. We seek to invest in business whose assets are intangible and difficult to replicate

4. We never engage in ‘Greater Fool Theory’

5. We avoid companies that need leverage

6. The business we seek must have growth potential

7. We seek to invest in resilient business

8. We only invest when we believe the valuation is attractive

9. We do not attempt market timing

10. We are not fixated on benchmarks

11. We are global investors

12. We don’t over diversify

13. Currency Hedging, or the lack of it

Can I invest into Fundsmith if I am just a retail investor in Singapore?

Fortunately, Fundsmith is easily accessible via Investment-Linked policies (ILP) for retail Investor. At the moment, there are three insurers that carry Fundsmith in their ILP plans, namely Tokio Marine, Singlife and AXA.

In conclusion, one must decide if they wish to take flight or fight when it comes to investing. First and foremost, you should also assess your risk profile before determining your portfolio allocation. Speak to our licensed financial advisors if you wish to have a second opinion and to know what your options to investing in Singapore are.

ertertyt ytr yty tryrtsy rt yrt ysrtysrt aer y