Life expectancy in Singapore has been on the upwards trajectory since 1960s. One of the concerns with increasing life expectancy is that it also increases the risk of morbidity such as age related disease, heart related conditions and cancer.

As such, one may seek financial protection against critical illness as a form of income replacement, or even as a potential source of financing alternative medical treatments (that are not covered under Integrated Shield plans) when illness strikes. An interesting trivia of critical illness is that the idea of Critical illness insurance was brought forward by a South African Doctor Marius Barnard who saw the financial hardship that his patients suffered after he had treated them of their critical illness.

Critical illness can be categorized into early, intermediate and severe stage. With the advancement in medical science, statistics of a favorable prognosis following critical illness diagnosis has been increasing. As such, multi-payout critical illness plans have recently been the ‘go to’ policy for people looking for comprehensive critical illness coverage as the multi-payout feature is crucial for longer-term illnesses that may recur over time.

In this article, we will be comparing 2 popular Multi-Pay Critical illness plans in Singapore.

Comparison of Singlife Aviva My Multipay CI IV Vs Tokio Marine MultiCare

| Plan |

Tokio Marine MultiCare |

Singlife Multipay Critical Illness |

| Plan Type |

Standalone CI plan |

Standalone CI plan or be added as a rider |

| Coverage term |

Till age 70/75/85 |

Flexible choice of coverage of 10 and up to age 99 (ANB), at every one year interval. |

| Total potential sum assured payout (CI) |

Up to 900% of sum assured |

Up to 900% of sum assured |

| Premium waiver |

Can be added as a rider. Premium waived upon Advanced CI Diagnosis |

Part of policy feature. Premium waived upon 300% of payout |

| Upon Early/Intermediate CI Payout |

- 100% of sum assured per claim

- Up to 2 claims

- No waiting period

|

- 100% of sum assured per claim

- Up to 6claims

- One year waiting period between each early CI claim

|

| Upon Severe CI Payout |

- Up to 300% of sum assured per claim

- Up to 2 claims

- One year waiting period between each severe CI claim

|

- Up to 300% of sum assured per claim

- Up to 2 claims

- One year waiting period between each severe CI claim

|

| Recurrent CI Benefit |

- For Major Cancer only, pays 100% of sum assured per claim

- Up to 2 claims

- 2 years waiting period between each recurrent cancer claim

|

- For 6 types of CI only, pays 150% of sum assured per claim

- Up to 2 claims

- 2 years waiting period between each recurrent CI claim

|

| No. of CI groups covered |

40 |

60 |

| No. of Special Benefits covered |

10 |

16 |

| No. of Juvenile Benefits covered |

10 |

11 |

| Death Benefit |

10% of sum assured |

$5,000 |

| Maximum Early CI payout per claim |

$350,000 |

$250,000 |

| Unique Policy feature |

|

- Intensive Care (ICU) Benefit

- Advance Care Option Benefit

- Benign and Borderline Malignant Tumor Benefit

|

Conclusion

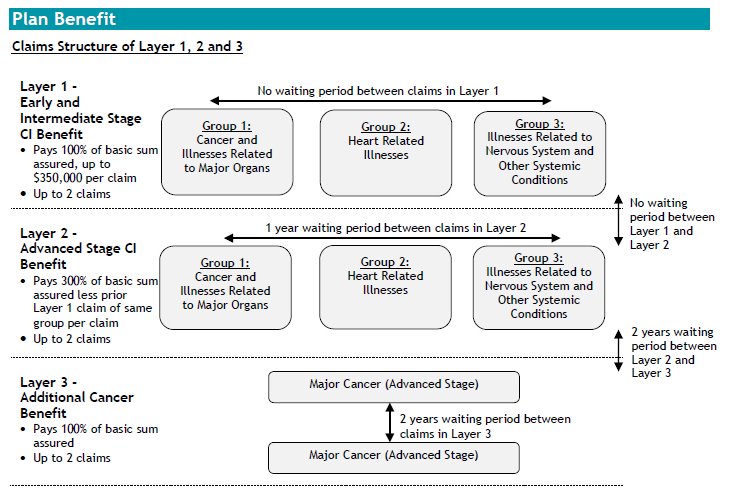

Why you may like Tokio Marine MultiCare:

For early stage CI claim, MultiCare pays up to 2 claims, with no waiting period between each claim. The plan also has a higher maximum early CI payout of $350,000 per claim.

Why you may not like Tokio Marine MultiCare:

The pay-out structure for MultiCare may be limited due to the 3 different groupings of critical illness that falls under:

- Cancer and Illness related to Major Organs

- Heart Related Illness

- Illness related to Nervous System and Other Systemic conditions

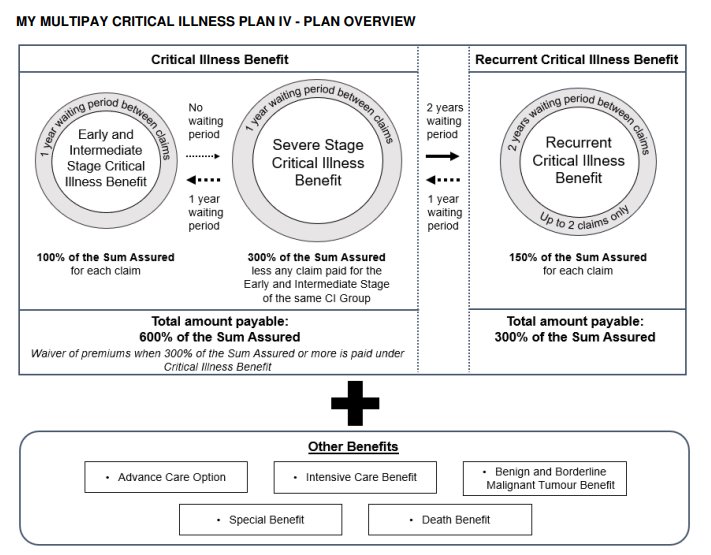

Why you may like Singlife Multipay Critical Illness:

My Multipay CI IV covers a wide scope of critical illness, as well as benign and borderline tumour benefit. With the Advance Care Option, the insured may opt to have a higher sum assured payout in the event of severe stage CI.

Why you may not like Singlife Multipay Critical Illness:

There is a one year waiting period between each early CI claim.

How much coverage do you need: (Where to start?)

Each individual will have their own unique financial profile and have different needs to address. The first step is to understand what your personal Critical illness insurance gap is. If you are still unsure which plan is suitable for you, or require advice on your critical illness coverage, speak to our financial advisors to do a more detailed recommendation.

ertertyt ytr yty tryrtsy rt yrt ysrtysrt aer y